Number of people making lump sum withdrawals from pensions as soon as they can hits record high

• 288,600 people aged 55-59 making lump sum withdrawals last year

• £37.7bn withdrawn from pensions in last five years

The number of people making lump sum withdrawals from their pensions as soon as they are allowed hit a record high last year, raising concerns that many will not have enough savings left when they actually retire, says Salisbury House Wealth, the leading financial adviser.

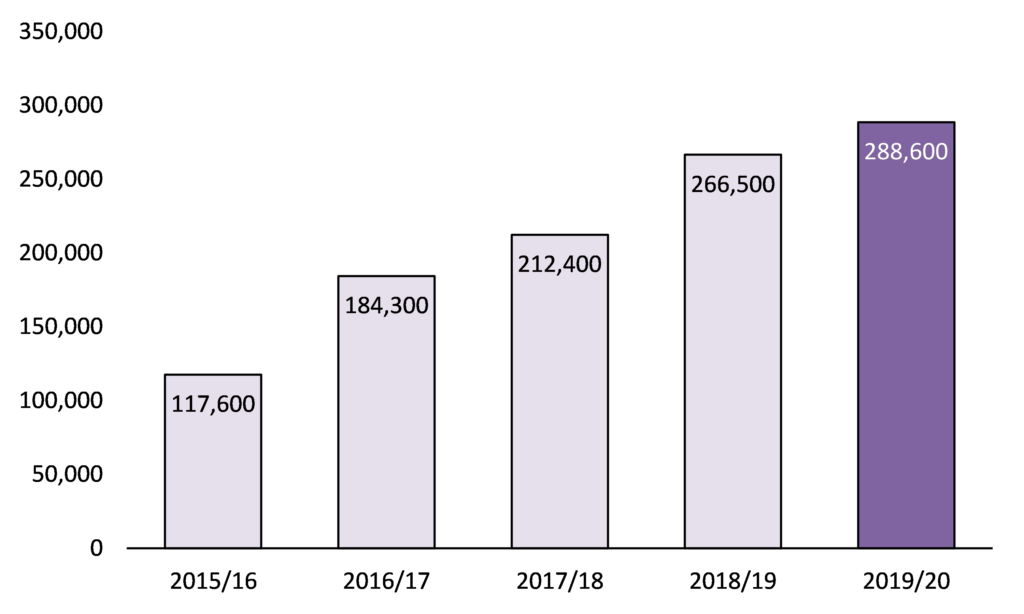

Data obtained by Salisbury House Wealth shows a total of 288,600 individuals aged 55-59 accessed their pensions last year, up 8% from 266,500 in 2018/19 (see graph).

Individuals have been able to access their pensions from the age of 55 since new pension freedom laws were introduced in 2015. The government recently announced that this age threshold will be raised from 55 to 57 in 2028.

Salisbury House Wealth says it has become increasingly popular in recent years to take lump sums from pensions early. The amount withdrawn from pensions since new freedom laws were introduced reached £37.7bn as of June 30 2020. £2.3bn was withdrawn last quarter alone.

However, the firm adds that accessing pensions early leaves people exposed to running out of money part way through their retirement. This is a growing concern given that life expectancies are continuing to increase, which means people are having to fund longer retirements.

The number of people aged 80+ in the UK is forecasted to rise 35% in the next ten years alone to 4.6m in 2030, up from 3.4m in 2030.

A growing number of people in the future could also face having to fund retirements that last over three decades. The number of people aged 100+ is expected to reach 117,000 by 2070, up from just 19,000 in 2020.

Tim Holmes, Managing Director at Salisbury House Wealth, says: “The number of people dipping into their pensions early continues to hit new highs. They need to be careful.”

“Life expectancies mean people could face larger costs later in life, such as care home and nursing costs than they expect. Anyone accessing their pension early needs to take that into account.”

“Longer life expectancies will have a particularly significant effect on those people who have just started working and saving into a pension. Their retirement may last 25 years or more.”

The data obtained by Salisbury House Wealth shows 68,600 people individuals aged 55-59 accessed their pensions in the second quarter of this year, between April 1 and June 30, at the height of the coronavirus pandemic.

Tim Holmes adds: “Coronavirus has put unprecedented strain on people’s finances which may have led some to dip into their pension as a way to tide them over – the lower income they are getting through furlough.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986, and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products. These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.

Number of people accessing pensions aged 55-59 hit a record high last year