Growth in number of high-earning millennials far outpaces other generations – up 22% last year

• Tax reliefs allow high earners to save more for their retirement

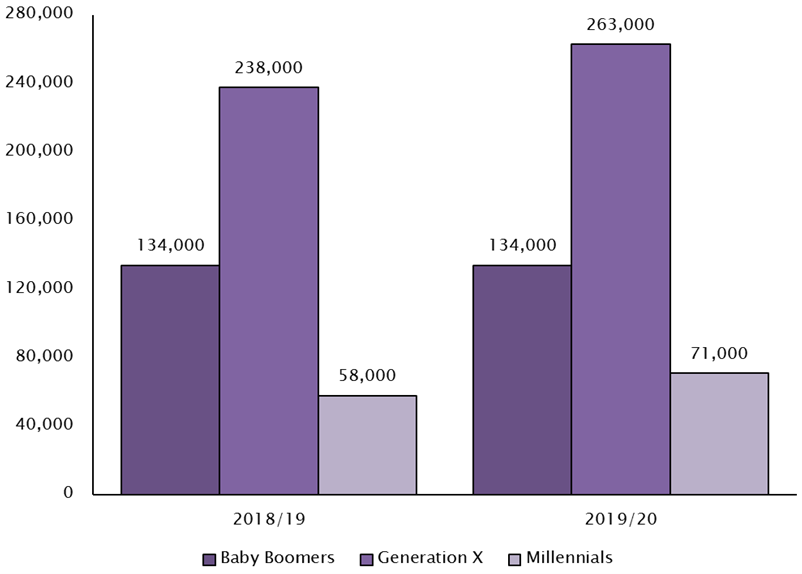

The number of UK millennials earning £150,000 (the top tax category in the UK) or more has increased by 22% to 71,000 in the past year, up from 58,000 the previous year*, far outpacing the growth in high-earning Baby-boomers and Generation X, says Salisbury House Wealth, the leading financial adviser.

The boom in high earning millennials is largely due to a boom in remuneration for workers in the tech sector (especially those with shares or options) and a broader boom in millennial entrepreneurship.

Millennials have continued to be attracted towards starting up their own businesses due to a constant supply of role models such as Ben Francis, who founded fitness clothing brand Gymshark, which has recently been valued at more than £1bn.

Advances in in technology and social media have enabled businesses to be started and scaled up much more cheaply, allowing more millennials to become entrepreneurs. In the past entrepreneurs had to have seed funding just to purchase IT equipment such as servers and software. Cheap processing power means young entrepreneurs can rent almost their entire IT infrastructure through SaaS and cloud computing.

The past year of lockdown has also encouraged younger generations to start their own business as an extra source of income, particularly those who have been furloughed or made redundant.

Salisbury House Wealth says high-earning millennials should make a conscious effort to save for retirement and maximise use of tax reliefs as their earnings may prove to be more volatile than those of previous generations. Savers should make full use of ISAs, which allow individuals to save up to £20,000 per year tax-free. High-earners with a higher risk appetite could also consider utilising tax reliefs by investing in growth companies through VCTs, where investors can claim 30% income tax relief on investments up to £200,000.

Since April 2020, the ‘threshold income’ limit for pensions which previously applied to individuals with earnings of £110,000 or more per year (net of all pension contributions) has increased to £200,000. This means the annual allowance of £40,000 now applies to thousands of more high earners enabling them to make bigger contributions to their pensions, tax-free.

During lockdown, individuals have been able to make significant contributions to their savings as they spent considerably less on leisure activities such as holidays and dining out. As a result of these extra savings, many millennials and Generation Z’s have used this time to either venture into investing or add to their investment portfolios.

There has also been growth in the number of individuals earning £150,000 or more each year for Generation X, increasing 11% to 263,000 last year, while the number of Baby Boomers in the top income tax bracket has remained unchanged at 134,000.

Tim Holmes, Managing Director at Salisbury House Wealth says: “The pandemic has shown just how easily income levels can be impacted. With the number of high-earning millennials on the rise, these individuals should be putting away as much as they possibly can for their retirement.”

“A growing cohort of millennials have invested into the stock market and other assets for the first-time during lockdown. They need to make sure to follow simple, straight forward steps such as having a diversified portfolio across geographies, sectors and asset classes.”

“Millennials mustn’t forget to take advantage of the various tax reliefs whilst they are still available. We may see tax changes to recoup Covid-related spending, which leaves the future of some tax reliefs hanging in the balance.”

“By maximising use of the annual allowance for pensions early on, this will reduce the stress of having to catch up on saving for retirement later down the line.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986, and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products. These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.