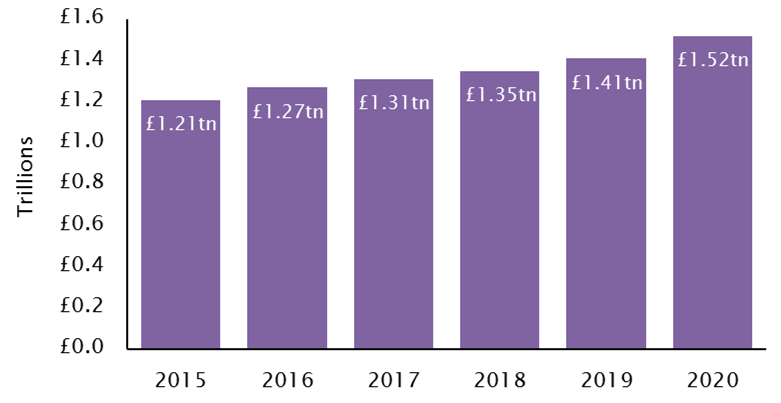

UK personal savings hit £1.5 trillion for first time ever, driven by COVID-19 lockdown savings boom

• Money saved on holidays, commuting and going out added another £98bn to UK accounts

• Extra savings could be doing much more for savers in pension pots

The amount in UK personal bank accounts* hit £1.5 trillion for the first time (as of Dec 31 2020) as the lockdown triggered a boom in savings, shows new research by Salisbury House Wealth, the leading financial adviser.

Money saved through reduced spending on holidays, commuting and dining out has allowed UK savers to add £98 billion to their bank accounts and cash ISAs since March 2020 – a 7% increase.

Tim Holmes, Managing Director at Salisbury House Wealth: “A sharp drop in spending has created a savings windfall.”

“Shocks to the economy often cause people to cut discretionary spending and build up cash. This time around, that build in cash has been put on steroids by the physical closure of a large part of the leisure and retail sector.”

“But with bank accounts offering negative real returns savers should review whether they can move some of that cash out of bank accounts into better performing long term investments.”

“Once savers have built up a comfortable cash cushion they could find they are better off over the long-term by moving surplus cash into their pension or stocks and shares ISA. The alternative is to see that cash gradual get eroded away by inflation.”

Leaving too much money in bank accounts may be a poor choice as traditional bank accounts have zero or have extremely low interest rates, with average interest rates on savings accounts now just 0.19% and 0.52% for an average fixed rate ISA. For many people this means their cash will be growing at a slower rate than inflation, creating native real returns.

Savers with a long-term view may want to consider investing some spare cash in equities which have outperformed all other asset classes. Since 1925, UK equities have returned 12.4% a year, higher than global bonds at 6.6% and cash at 4.9% per annum.

Tim Holmes adds: “The coronavirus lockdown has given people a rare chance to build up a good cash buffer but their money is often not working as hard for them as it should.”

“They could just spend this extra cash when the economy reopens or they could properly invest that money and see it grow into quite a sizeable nest egg.”

“The Bank of England is not expected to increase interest rates for the foreseeable future, meaning that bank accounts will gradually chew up those deposits.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986 and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products. These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.