Rates on ‘best buy’ ISAs have nearly halved in a year, dropping 48%

• Interest rates expected to remain low following coronavirus crisis

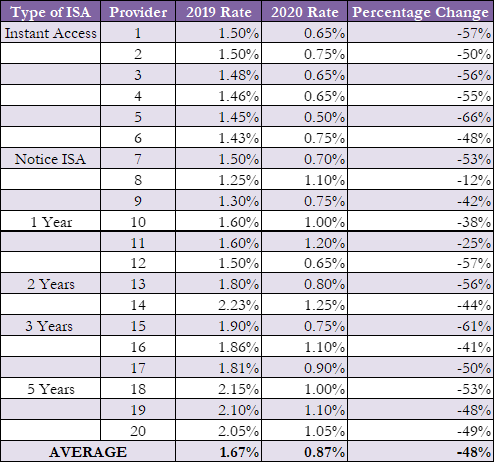

The average interest rates on last year’s Top 20 ‘best buy’ cash ISAs have nearly halved to just 0.87% per annum, down from 1.67% last year*, shows research by Salisbury House Wealth, the leading financial adviser (see table below).

Savers have long complained that a lack of competition between banks and record low Bank of England interest rates means it is impossible for them to get a good deal on conventional savings accounts.

Despite negative real interest rates on accounts, savers have continued to pour money into cash ISAs. The number subscribing to cash ISA accounts increased 20.8% to 8.5m in the last year, with amounts subscribed increasing 19.8% to £44bn, up from £36.7bn the year before**.

Savers were dealt a further blow in March when the Bank of England cut interest rates for the second time in 2020. In response to coronavirus, rates were reduced from 0.75% to 0.25% at the beginning of March, to just 0.1% a week later. As a result, cash products currently offer historically low returns to savers.

Salisbury House Wealth says that cash saving products are expected to continue to underperform, as interest rates are unlikely to be increased during the pandemic. There are also fears that consumer inflation might be rising faster than official figures suggest, which means that cash ISA savings are eroding faster (in real terms) than thought.

As the Government looks for strategies to ease the debt accumulated during the coronavirus crisis, there are concerns that it may turn to what is called, by some commentators, “financial repression”. This involves offering ultra-low interest rates and elevated rates of inflation. The sum impact of that could be more pain for savers who leave their money in traditional style savings accounts.

Investors that stagger their investment into the stock market may see better returns, despite current volatility.

Equities have typically outperformed other asset classes over the long-term. Since 1925 equities have delivered average annual returns of 12.4%, higher returns than cash (4.9%), global bonds (6.6%), rental property (7.2%) and gold (7.7%).

Instant access cash ISAs offer the worst rates for savers at an average of 0.66%, down from 1.47% the same period last year.

Tim Holmes, Managing Director at Salisbury House Wealth, says: “Savers have struggled with ultra-low interest rates and it looks like they face more years of negative real returns.”

“Obviously investors need to be careful about when they put large lump sums into the stock market but historically, cash woefully underperforms.”

“The best approach to investing is to have a diverse portfolio with a range of asset classes that have a relatively low correlation such as some forms of fixed income as well as equities.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986, and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products. These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.