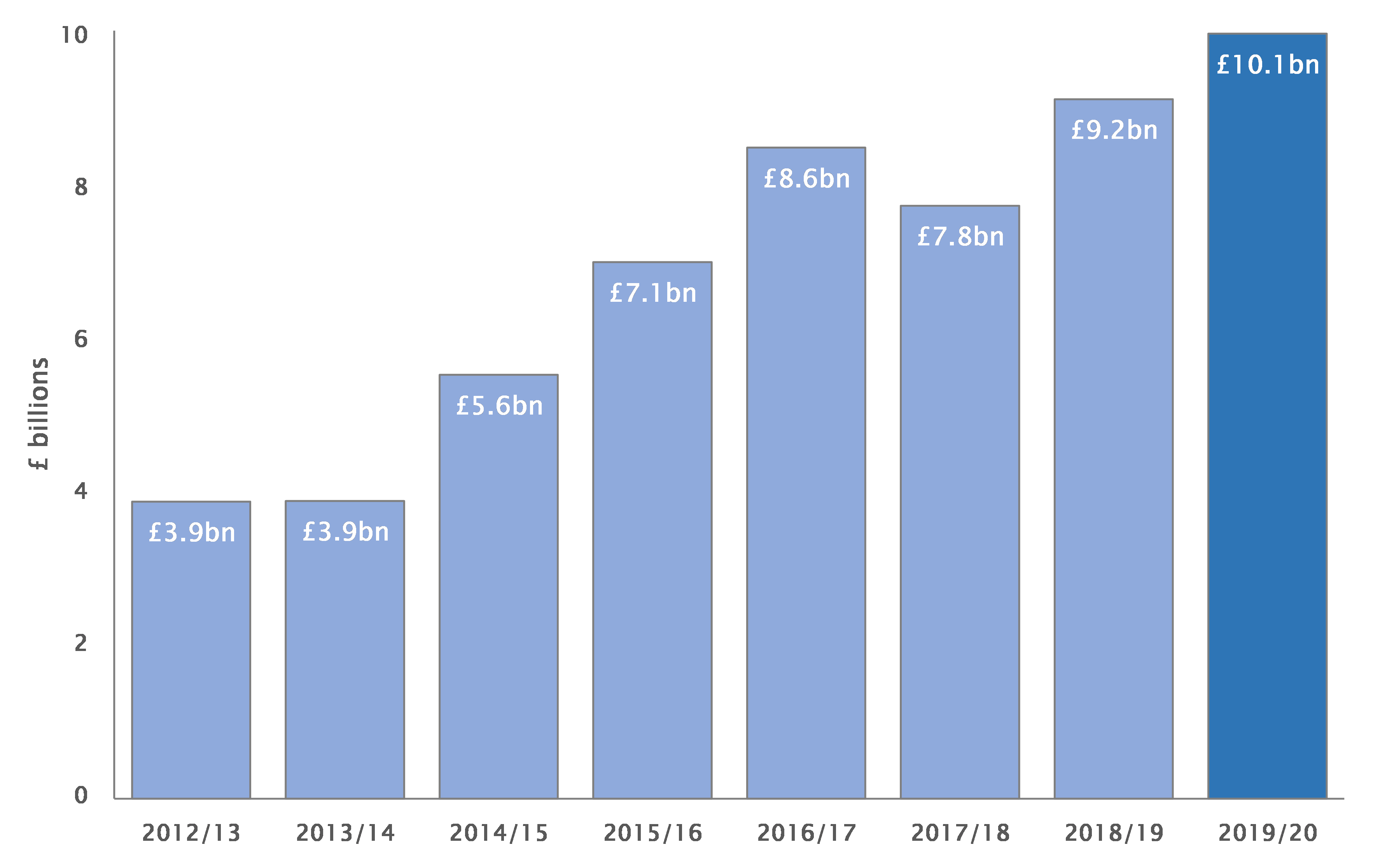

UK’s Capital Gains Tax bill tops £10bn for the first time as taxpayers sell assets to avoid possible CGT rise

• Fears Chancellor will raise CGT rates soon

• Buy to let property, business stakes could soon attract huge CGT bills

The UK’s Capital Gains Tax bill has topped £10bn for the first time* as taxpayers rush to sell assets ahead of feared increases to CGT says Salisbury House Wealth (SHW), the leading financial adviser.

The Office for Tax Simplification recently recommended that the Chancellor increase CGT rates in line with rates of Income Tax, as well as making inherited assets subject to both CGT and Inheritance Tax.

The OTS report added to longer-running concerns that the Government may look to raise more money from CGT. Business owners’ worries ahead of the restriction of Entrepreneurs’ Relief earlier this year also triggered hurried sales of businesses by entrepreneurs.

Salisbury House Wealth says these concerns have led more individuals to sell assets that might attract even bigger CGT bills in the future, such as buy to let property. It has also been reported entrepreneurs have accelerated sales of businesses in recent weeks in order to avoid any increase in CGT.

It also warns taxpayers to take professional advice before hastily selling assets in fear of a rise in CGT. It says that too many people do not understand the full tax implications of these decisions and can end up paying more tax than is necessary.

Other options that many people selling assets overlook include:

• Making full use of your pension. Even if you plan to hold an investment for the short term consider buying that asset inside a pension wrapper to make any gains on sale CGT-free

• Investing a gain from the sale of an asset into an EIS investment, deferring the CGT bill until that investment is sold

• Sell all of an asset across more than one tax year and use each year’s £12,300 tax-free allowance

Tim Holmes, Managing Director at Salisbury House Wealth, comments: “It’s understandable that people are worried about CGT rates rising but if they rush, it could cost them much more than necessary in tax.”

“There are many other options that might make more financial sense than just selling and paying the tax this year. ‘Rolling over’ gains into an EIS investment and making sure you buy an asset inside a pension wrapper are both quite simple steps that may work well for some.”

“It’s also vital to make sure you use as much of your tax-free allowance on capital gains as possible – spread sales over multiple years if you can.”

“The rumours swirling around CGT rises are very unhelpful to taxpayers – they put pressure on them to make risky decisions about what to do with their assets. It would be good to see the Chancellor quickly provide clarity about the future of CGT so people don’t lose out unnecessarily.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986, and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products.

These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.