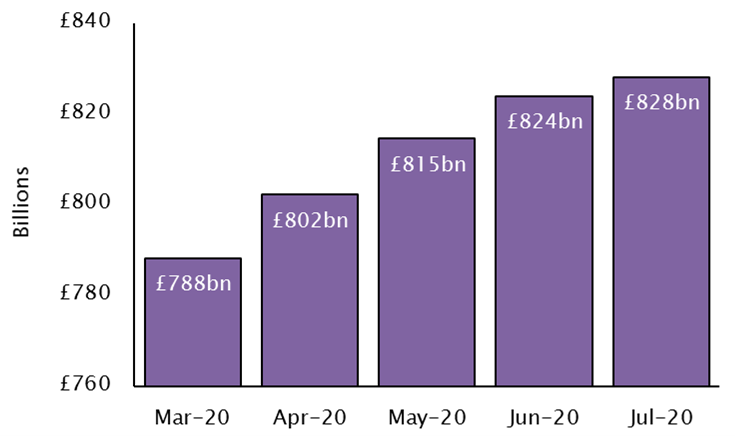

Amount saved during lockdown grows at double average monthly rate over last decade

• Savings in bank accounts increase to £828bn in the last five months

• Spare cash could be used to invest for the long term

The amount saved in UK bank accounts during lockdown has grown at more than double the average monthly rate over the last decade, due to restrictions on spending, shows new research by Salisbury House Wealth, the leading financial adviser.

The amount saved in interest-earning bank accounts increased at an average monthly rate of 1.3% during lockdown*, faster than the average rate over the last ten years of just 0.5%**. The amount saved in bank accounts reached £828bn in July 2020.

Savings in non-interest earning bank accounts, such as current accounts, rose at an average monthly rate of 2.1% during lockdown, compared to 0.9% over the last ten years. The amount saved in these accounts reached £205bn in July 2020.

Lockdown restricted many individuals from spending money on shopping, holidays and entertainment for several months, which has resulted in them saving more.

The amount saved due to these restrictions on spending will have quickly added up for some people. Latest ONS data shows the average household spends £51.30 a week on eating out at restaurants and £41.30 on package holidays.

However, Salisbury House Wealth says leaving excess money in bank accounts may be a poor choice as traditional bank accounts have zero or extremely low interest rates, with average rates on current accounts now just 0.07%. For many people, this means their cash will be growing at a slower rate than inflation, eroding the value of their money over time.

Despite low interest rates, savers often choose to deposit their money into standard bank accounts due to the perception that other forms of saving, such as ISAs, will mean their money will be locked away and not be usable.

However, there are instant-access cash ISAs that offer far better rates than bank accounts and allow withdrawals to be made at any time. New flexible ISA rules also enable consumers to withdraw money from cash ISA accounts and then deposit the money again without affecting their £20,000 annual limit.

Salisbury House Wealth says the rise in savings during lockdown presents individuals with a unique opportunity to use any spare cash and invest, to generate higher returns over the long-term. This is particularly important for those saving for retirement.

Savers with a long-term horizon may want to consider investing some spare cash in equities which has outperformed all other asset classes. Since 1925, UK equities have returned 12.4% a year, higher than global bonds at 6.6% and cash at 4.9% per annum.

Tim Holmes, Managing Director at Salisbury House Wealth, says: “The coronavirus lockdown has given people a rare chance to build up a good cash buffer.”

“They could just spend this extra cash when the economy reopens or, instead, they could properly invest that money and see it grow into quite a sizeable nest egg.”

“Cash has historically underperformed all other asset classes. It is therefore important savers with a long-term horizon look at investing in assets that offer higher risk-adjusted returns.”

Notes to Editors

Salisbury House Wealth is a leading financial advisor founded in 1986, and based in Leicester.

Salisbury House Wealth offers specialist professional advice to high net worth and mass affluent individuals on a range of financial products. These include mortgage and pension plans, investment programmes, inheritance tax plans and life insurance.